Ontario Bonds

- Secondary market liquidity with a wide range of offerings provide extensive investment and trading opportunities across the yield curve

- Ontario accounted for 67.4 per cent of Canadian provincial bond trading in 2024

- Attractive spreads provide opportunities for investors to achieve higher returns

- Benchmark Canadian provincial borrower

- Primary focus on Canadian dollar borrowing with likely issuance in U.S. dollars and Euro

| Credit Ratings (Long-Term/Short-Term) | |

|---|---|

| Moody’s Investors Service | Aa3 / P-1 |

| Fitch | AA- / F1+ |

| Morningstar DBRS | AA / R-1(high) |

| S&P Global Ratings | AA- / A-1+ |

June 3, 2025

Foreign Denominated Bonds – NEW!

May 15, 2025

2025 Ontario Budget

Borrowing Program

2025–26 Borrowing Program

| Total Long-Term Public Borrowing: | $42.8B |

|---|---|

| Borrowed as of | $12.1B |

U.S. Dollar Bond $2.7B

Canadian Dollar Syndicated Bonds $9.3B

Note: Numbers may not add due to rounding.

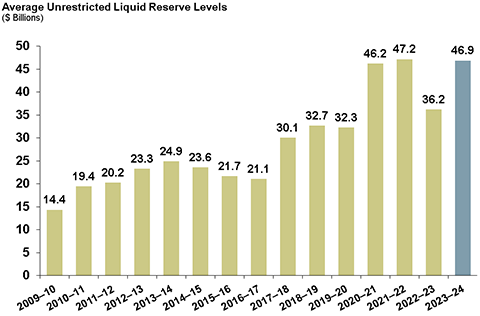

Liquid Reserves

- Ensuring Ontario always has sufficient liquidity to meet its cashflow needs to continue to address any unforeseen economic or public health needs.

- Ontario cash reserves for 2024–25 averaged $41.9 billion.